Key terms

- KeyBank even offers an effective doctor’s financial all the way to $1M with 0% down to own medical professionals, dentists, and dental surgeons doing in the us.

- You can aquire doing $step 3.5M into the investment or refinancing having a down payment with no private financial insurance rates (PMI) is required.

- That it home loan can be found with no minimum otherwise maximum years used, it isn’t really offered to residents or fellows.

KeyBank, a part away from KeyCorp , is a major federal bank in the usa, headquartered during the Cleveland, Ohio. Serving the public once the 1825, you can aquire a professional healthcare provider’s mortgage regarding KeyBank which can allow you to get in the future from the business of home ownership. Whenever you are a medical expert that recently finished and you’re now practicing, this choice could help you getting homeownership smaller. At exactly the same time, if you were exercising for many years and you are clearly hoping to purchase inside a primary residence, this may be also to you.

As to the reasons choose KeyBank? Many traditional real estate home loan apps aren’t available in order to scientific students or healthcare experts who has actually large volumes from outstanding student financial obligation that can arrived at for the thousands of cash. On average, scientific students in the usa graduate having between $2 hundred,one hundred thousand and $three hundred,000 when you look at the student education loans, and this has an effect on your credit rating most. Because your credit score are taken into account whenever trying to get a mortgage, this may introduce an issue.

A healthcare provider’s mortgage out-of KeyBank can help you attain your own fantasies of homeownership after you might be a training elite, which can help enormously on your way to financial freedom.

Pros/Disadvantages off KeyBank medical practitioner mortgage loans

KeyBank keeps numerous loan options to select to challenge towards your coming. In spite of how enough time you’ve been training and you may even qualify rather than Us citizenship.

Zero minimum otherwise limit years used. Many other doctor’s mortgage loans need you to was in fact practicing within the medical profession for no more than 5 or 10 years. Having KeyBank, you could potentially get good healthcare provider’s home loan at any time on your own job. This is a distinct advantage just in case you ily family or condominium after in life as well as folks who are to buy an effective 2nd otherwise 3rd home otherwise looking to re-finance property. KeyBank does not stipulate its funds are only offered to first-go out homebuyers, undertaking wider access.

It’s not necessary to be an excellent You resident. This mortgage program is obtainable so you can People in the us, and get permanent residents, as well as men and women involved in the us towards the a keen H1B charge.

You might increase than just maximum loan amount listed. Research indicates you might get a mortgage that have KeyBank for more than $dos,100,one hundred thousand. You need to be aware you’ll likely be required to has 15% to 20% or higher to place to your deposit based your own loan-to-value (LTV) of your home.

Delayed work go out is alright. You can receive that it doctor’s mortgage having evidence of a position (playing with a deal page or employment contract) to ninety days shortly after your closure big date, plus coming money could well be felt to have acceptance.

Flexible data. Special formulas are used whenever calculating your debt-to-income proportion. This means the beginner loans wouldn’t damage the job normally as it can certainly whenever applying for a traditional home loan. Income-inspired student loan money are included.

- 29, twenty-five, https://cashadvancecompass.com/loans/guaranteed-approval-10000-loans/ 20,15 and you will ten-year fixed-rate mortgages

- 5/six,7/6, and you can ten/six variable-rates mortgage loans (ARM)

No prepayment punishment. Instead of with a few mortgage loans given by opposition, you will never getting punished that have a lot more fees for folks who pay off your loan prior to when organized or generate a lot more monthly premiums.

Cons

Fees. KeyBank charges a loan provider commission of $step one,095 so you’re able to process your home loan, there also are almost every other settlement costs you to definitely meet average fundamental 3rd party costs.

Cover into DTI percentages. This method caps the debt-to-money (DTI) ratio at the 50%. This really is each other bad and good. A beneficial DTI from 50% are large incase you do choose apply for a good mortgage using this and allow it to be, you could have limited funds available for a crisis condition, also restricted extra borrowing alternatives.

Minimum credit history. KeyBank means one has a minimum credit history away from 700, that’s on the average in the us. For those who have a lesser credit score than just which, you will never meet the requirements.

People and fellows do not qualify. Which doctor’s mortgage isn’t as acquireable since the others (excludes veterinarians) and that is simply open to physicians, dental practitioners (DMDs), and you can dental care doctors.

- two months supplies having finance around 500k

- cuatro months reserves to own funds over 500k

- 6 months reserves having loans more than 750k, plus a supplementary two months in the event that closing early in the day your own begin date

Simple tips to incorporate

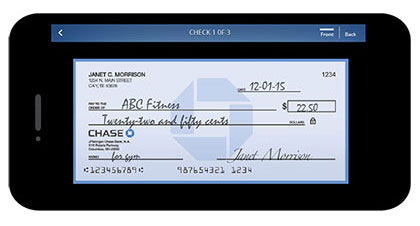

To try to get a great doctor’s home loan with KeyBank, look at the organization’s webpages and appearance the directory to locate a good real estate loan officer towards you. It’s also possible to name KeyBank during the: 1-888-KEY-0018

Whenever obtaining home financing might have a tendency to need supply personal data to help you mortgage lenders having underwriting that can include the following:

- The full name

KeyBank now offers a competitive physician mortgage to your option to likewise have 0% down. When you’re an operating medical professional in the usa that have an average or over mediocre credit rating, this choice was beneficial for you.

If you are searching to understand more about medical practitioner mortgage loans in your condition, check out all of our county-by-county self-help guide to physician money while the a kick off point on your lookup.

Joshua Holt is an authorized mortgage maker (NMLS #2306824) and you may creator regarding Biglaw Investor. Their mortgage systems lies in the areas out-of professional mortgages, especially for solicitors, physicians or any other high-income benefits. Before Biglaw Investor, Josh experienced private security mergers & purchase legislation for 1 of the largest law firms regarding the nation.

Recent Comments