The lending company americash loans River Falls understands it does struggle to break-even because of the supposed down it path which create far rather the latest borrower remain paying the home loan

- The lending company will attempt so you can access possessions from the debtor prior to carrying out action up against the guarantor. If this sounds like something, look for separate legal services.

Someone anxiety one finance companies will circulate quickly to offer an effective guarantor’s where you can find shelter remaining debt after a default but finance companies was what you to settle the challenge prior to taking that it extreme action.

It does should work-out why the fresh new borrower has difficulties handling repayments and you can whether or not an answer is obtainable.

While a daddy whose child is incapable of rescue a deposit and also you will not want a number of the dangers regarding acting as an effective guarantor, a pops help financial could be better suited to the state..

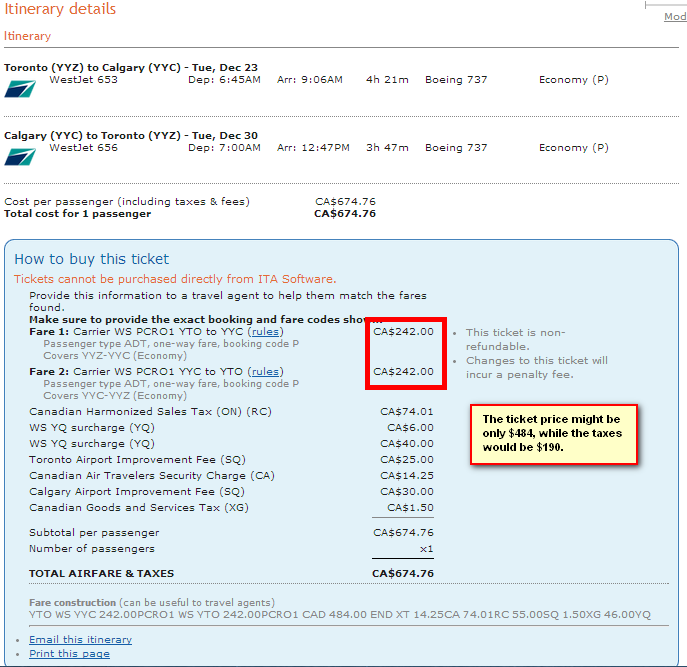

Including, should your a good personal debt is for $700,000, nevertheless restricted ensure is actually for simply $210,000, the newest guarantors are responsible for covering the a great mortgage merely up to $210,000.

If the property costs merely $440,000, although not, this new guarantor will have to cover-up to help you $210,000 which have equity in their possessions to purchase shortfall, however, will never be responsible for the remaining $50,000 [($700,000 ($450,000 + $210,000)].

Try to make so it choice prior to your borrower obtains home loan acceptance and you will cues this new Price regarding Revenue, otherwise new debtor may default into offer and get sued.

Guarantor Home loans Faqs

From the bank’s attitude, whenever you are credit more than 80% of the property’s well worth then there’s a go that they manages to lose currency if you cannot make your costs. Because of this it charge a fee a fee labeled as Lenders Home loan Insurance coverage (LMI) to protect by themselves if there is a loss of profits.

Although not, having a pledge given that extra security, the lending company takes into account your loved ones vow financing to get under 80% of your property value your residence together with the guarantee’s worth.

In case your parents actually have a home loan shielded on their assets, then your ensure must be covered of the the second mortgage.

This is simply not a problem usually; not, it can be a problem if for example the app isn’t published to the lending company precisely.

The lending company understands it does be unable to break even from the heading off that it highway which carry out far as an alternative new borrower keep make payment on mortgage

- Agree for the next home loan might have been supplied.

- A bank valuation has been finished on your guarantor’s possessions.

- Your bank keeps granted an official acceptance.

The lending company one to already features a mortgage secure on the parents’ property must accept to the fresh new make sure becoming secured on the the home. There can be a tiny risk that they can refuse otherwise withhold the newest concur, that leave you high and you may deceased.

Not too many lenders will allow you to get a property and you will consolidate their playing cards otherwise signature loans at the same time. We know and that loan providers makes it possible to roll that which you toward one particular, lower fees every month.

Keep in mind that you might only combine several small expenses, and in case your financial situation is more 5% of your own purchase price, then you’ll definitely struggle to roll all of them for the financial which have any financial. Your instalments have to be timely, anytime, prior to a loan provider makes it possible to blend all of them into the the fresh home loan.

The latest faster apparent likelihood of going into an excellent guarantor financing arrangement is that you separating with your spouse as well as the lover opting for not to build mortgage repayments.

Which not merely places you susceptible to default but could in addition to potentially place your moms and dads inside a great precarious condition.

Recent Comments