A home loan recast happens when you will be making a giant one-time percentage to minimize the home loan balance and your bank recalculates your own payment consequently. (This can be also referred to as a re-amortization of the financing.) Your financial restructures their payment per month schedule for the remainder of the loan term to help you account for brand new swelling-sum payment.

Recasting the home loan cannot alter your interest or mortgage words nonetheless it can help reduce your requisite lowest monthly payment and it can save some costs for the attract across the lifetime of one’s financing.

Not absolutely all lenders render recasting rather than most of the financing brands is actually eligible. You could potentially usually generate a swelling-share fee to decrease their dominating equilibrium but instead of a great recast their month-to-month homeloan payment carry out stay the same.

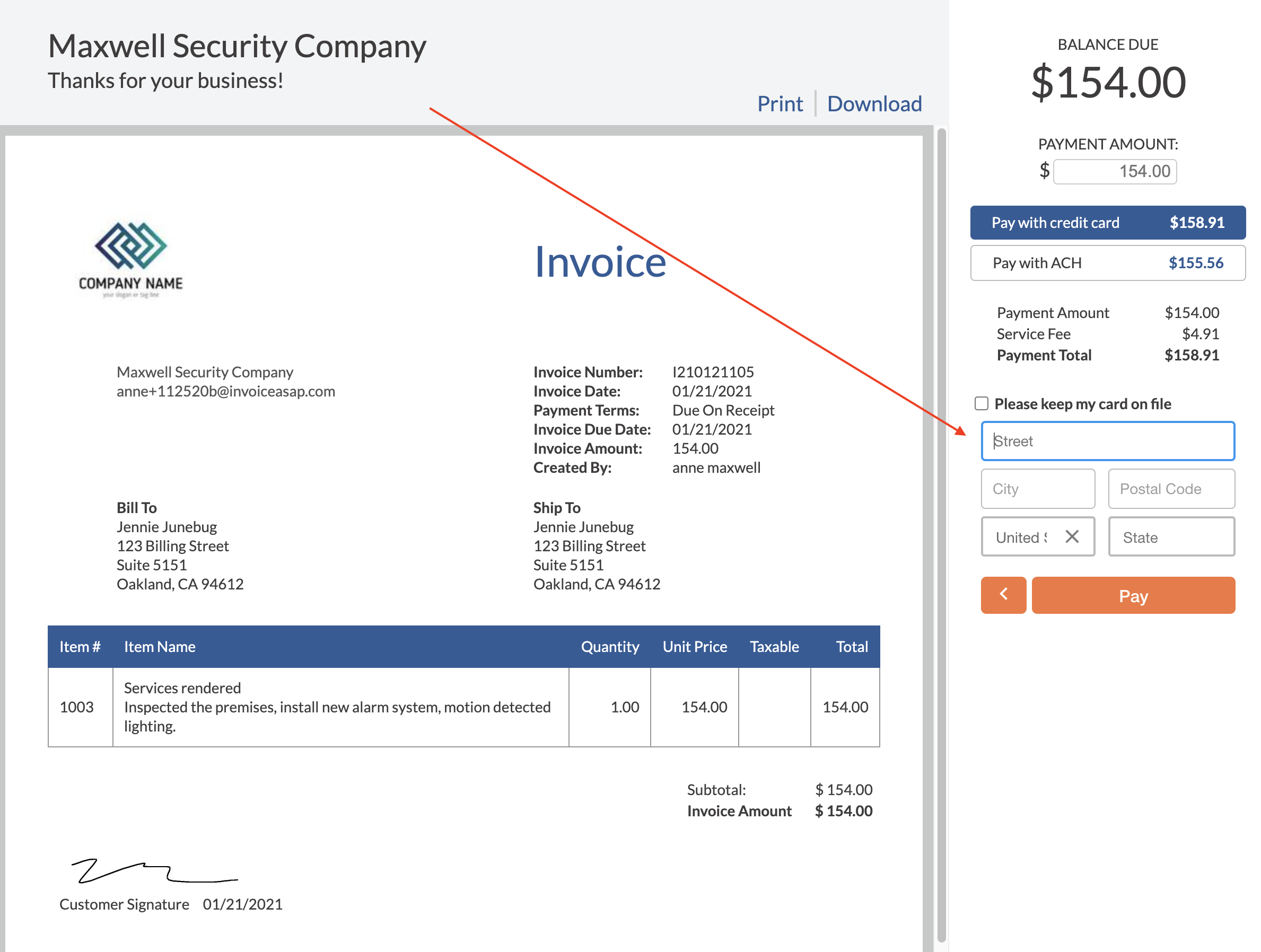

Home loan recast analogy:

When deciding whether to recast their financial, it has been better to go through the numbers to determine if the its convenient. Check out this home loan recast analogy.

In this analogy, the latest debtor might be able to get their financial in order to recast their financial and also have a unique all the way down payment per month to own prominent and you may notice.

Is it a good idea to recast your mortgage?

Recasting your financial have benefits and drawbacks. Once you build an enormous lump-sum percentage usually necessary for home loan recasting, you could lower your payment per month and you can possibly save money on attract money. And also make a swelling-share payment setting you will not get that money designed for emergencies or other expenditures, but not.

As well as, you are able to believe and make a lump-contribution payment one to reduces your prominent harmony although instant same day payday loans online North Dakota not recast your own home loan and keep maintaining the payment per month a comparable. The main benefit of to make a lump sum payment and you will preserving your payment similar to go against recasting the mortgage is that get enables you to pay off the home loan shorter. By paying off your mortgage reduced you may want to most likely save yourself so much more money in appeal along the lifetime of the mortgage.

In the event that you re-finance otherwise recast your own financial?

Recasting and you may refinancing are one another selection that may help your down their payment per month and you may reduce attention. Recasting means you to have a substantial amount of bucks in order to make a single-go out fee and won’t will let you replace your desire rates or other mortgage conditions, however.

Refinancing offers the ability to reduce your interest and you can probably reduce your payment or save on interest. Refinancing doesn’t require you to keeps a great number of cash while you will have to pay settlement costs and also you will need to meet your lender’s borrowing, income, and you will financial conditions to get your re-finance recognized.

Imagine both alternatives and decide the correct option for your. And don’t forget of the refinancing, the full fund costs you pay is generally higher across the lifetime of the loan.

How often do you recast their home loan?

You will find essentially perhaps not a threshold so you can how frequently your normally recast the mortgage, but recasting their mortgage usually comes with a charge. Which payment can be several hundred bucks and must feel factored to your choice so you’re able to recast. When you yourself have currently recast your own financial, you’re in a position to pay your financial early of the using your additional offers to blow off your financial prominent.

Recasting which have Freedom Mortgage

Will you be a current Independence Home loan customer that have questions about if or not you are entitled to recast your own home loan? Va, FHA, and you will USDA fund aren’t entitled to recasting. Old-fashioned loans is going to be eligible for folks who see the needs. Phone call one of the Customer support Representatives within 855-690-5900 to discuss recasting.

Recent Comments