Home loan Attract Deduction: the interest cost of home financing, that is a tax – deductible expenses. The interest decreases the taxable income out of taxpayers.

Financial Amendment: a loss mitigation solution that allows a debtor to help you refinance and you will/or extend the word of mortgage and therefore eradicate the newest monthly installments.

Freddie Mac and you can Fannie mae loans is named conforming fund

Financial Note: a legal document obligating a debtor to repay that loan at a reported interest during a selected several months; the agreement try secure of the a home loan that’s filed when you look at the individuals details plus the deed.

Financial Being qualified Ratio: Accustomed estimate the maximum amount of fund that an individual typically can pay for. A consistent financial qualifying ratio is twenty-eight: thirty-six.

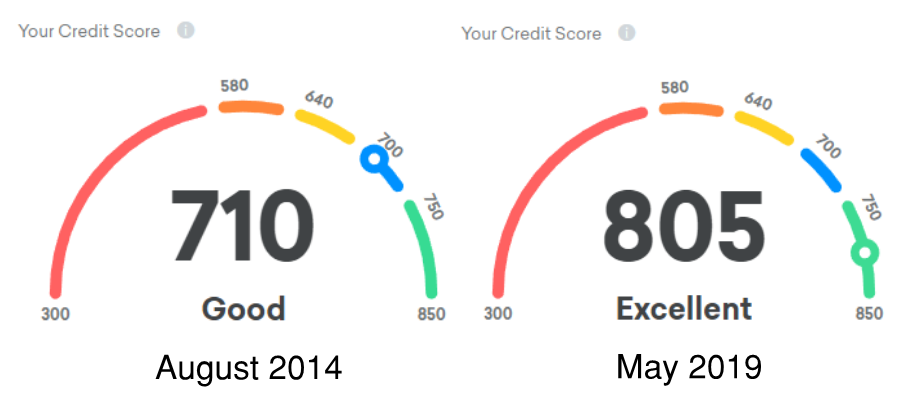

Home loan Rating: a rating based on a variety of information regarding the brand new borrower that is taken from the loan app, the financing declaration, and you can worth of pointers.

Multiple listing service (MLS): inside the Region Columbus city, Realtors fill in postings and you may invest in you will need to promote every qualities throughout the Mls. The brand new Mls are a service of your local Columbus Panel regarding Realtors. Your local Mls enjoys a method to own updating posts and you can discussing commissions. The fresh Multiple listing service supplies the advantage of a lot more prompt pointers, access, and you will use of property and other kind of possessions to your business.

Federal Borrowing from the bank Repositories: currently, you will find around three businesses that take care of federal credit – reporting databases. These are Equifax, Experian, and you may Trans Connection, also known as Credit agencies.

Bad Amortization: amortization means monthly obligations are adequate to spend the latest appeal and reduce the principal on your own home loan. Negative amortization occurs when the monthly premiums do not defense the of your appeal cost. The attention rates this is simply not covered try placed into the delinquent dominant balance. As a result even after and make of a lot money, you could potentially are obligated to pay over you did early in the loan. Bad amortization may appear when a supply enjoys a repayment cover you to leads to monthly obligations not sufficient to pay for notice owed.

No cash Aside Refinance: an excellent re-finance away from a preexisting loan simply for the quantity kept on home loan. The newest debtor does not get any cash from the security regarding the house. Often referred to as a great “speed and you may title refinance.”

Totally free Loan: there are many different distinctions out-of a free of charge loan. Essentially, it is that loan that will not charges having products particularly as the term insurance policies, escrow fees, settlement charge, appraisal, tape costs or notary charge. It may also give zero facts. So it reduces the necessity for initial cash from inside the to order techniques but not totally free fund possess increased rate of interest.

Note: a legal document obligating a debtor to repay a mortgage loan on a reported rate of interest more than a selected period of time

Nonperforming Advantage: a secured item including home financing that’s not already accruing interest otherwise and this attention isnt are reduced.

Find off Default: an official composed notice to a tribal installment loans borrower there is a great default to your a loan and that suit is possible.

Notional Prominent Number: the brand new recommended matter and that interest swap costs was situated however, basically perhaps not paid down or received by the possibly cluster.

Notary Societal: an individual who functions as a public-official and you can certifies the newest credibility regarding required signatures into the a file from the finalizing and you may stamping brand new file.

Offer: indication from the a potential buyer regarding a willingness to invest in good family at the a certain rate; basically put forth on paper.

Recent Comments