I never ever consider I’d be someone who got currency, and i also recognized one to. Scraping from the was exactly what my family did growing right up, while I had elizabeth better-trained from inside the scraping. My better half has been a bluish-collar staff member. We have put eating seal of approval, Medicaid, and you will WIC. We have ate ramen a couple night in a row. Into the several splendid times, We got goes of toilet paper regarding societal bathrooms household inside the my personal handbag in order to make it to pay-day.

Pregnant financial comfort wasn’t element of my personal upbringing or worldview, and i also was at peace inside it.

Today, out of the blue and you will without extremely definition so you’re able to, immediately after finishing graduate college or university and switching areas, I’m functioning full-time in a specialist career and then we was a soft twin-income-earning family unit members. I’ve some cash. I am not speaking of Disney-World-every-seasons sort of money. But out of the blue, I will fulfill surprise costssuch as good copay in the children’s dental expertwithout in search of an easy way to delay up to 2nd pay day. I could pay the bills versus fearing showing up in equal option to the calculator application. There isn’t to deal rest room paper!

Time out to check my privilege here. First, I’m not a single father or mother. And you may sure, whenever you are my husband and i been employed by hard, we’ve got including only started lucky. General racism has never put mainly based-within the barriers ranging from all of us and you may triumph. We supply a safety net in our group; whenever you are never ever financially supported by all of them during the adulthood, i’ve manage according to the degree that they provided a safety net off over destitution, is to they come to one to. Not everyone keeps you to morale.

You to definitely advantage firmly and you may knowingly accepted, I’ll press to the from the deep problemsactually taboosurrounding the main topic of currency and become frank with you here from the my personal newfound regard for money.

I’m shocked that simply how much simpler life is when you yourself have money.

Y’all, that have cash is Super. I do not believe I truly know that up to now. It will require A americash loans Central City whole lot rational times so you’re able to scrape from the financially. You are in a close-constant state out-of stress and anxiety, constantly and work out and revising rational computations and you will excellent deals. Numerous brain power is actually freed upwards while you are maybe not not able to generate $2.76 last about three even more months.

I also thought I’m sure, slightly, how those individuals greedy sorts of megarich Scrooges got how they are: since You will find money, I wish to ensure that is stays. They feels good getting money. When i had no currency, it had been particularly, whichever. If i discover which amount is not going to last right until 2nd pay check whatever the I really do, may as well have some fun once we can also be and wade off to consume!

Obligations Prevention

Given that I have some money, the thing i remember really try eradicating my obligations. Definitely, how you can beat debt isnt to build up one before everything else: I’m very happy with the truth that you will find no borrowing from the bank card debt after all, as an example, and you will we’ve prevented a vehicle percentage compliment of the higher fortune in the acquiring a hand-me-off car regarding my mom-in-legislation.

Our biggest loans (and you may greatest month-to-month debts), predictably, try construction. We purchased the basic home, an old rental possessions that was for the disrepair, within the 2018. I spend $1027 thirty day period on the all of our 31-season mortgage, but are already in the process of refinancing to good fifteen-seasons mortgage. Our very own monthly premiums is only going to increase by $268, however, our very own interest rate is certainly going off and we will save over $60,000 within the desire over the longevity of the loan!

We are obligated to pay regarding the $twenty-five,000 for the college loans of graduate school. My personal B.An excellent. try paid for with money-centered Pell has and you can instructional grants, so I’m lucky for escaped better education loan debt. As I operate in a public-service field, my student loans is forgiven after i generate 120 repayments on it. But not, more 99% of them who will be approved with the Public service Mortgage Forgiveness system is after that rejected if they have actually made the fresh qualifying payments and you will document to have their money forgiven. We not be able to decide whether or not to try to spend this type of finance off me personally eventually, or even wait and you will guarantee they shall be forgiven.

Vehicles Offers

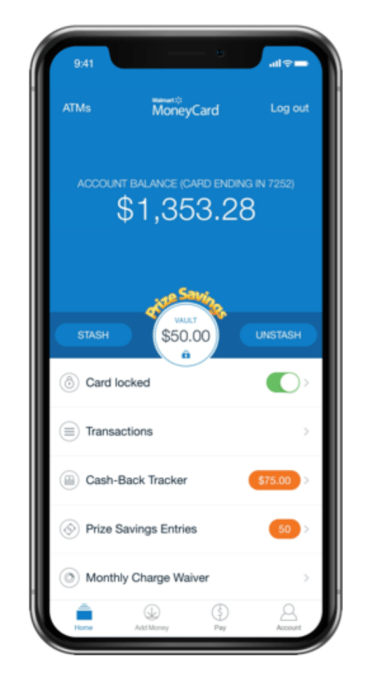

Our fundamental automobile is an excellent fifteen-year-dated SUV that have 233,000 kilometers inside. The new door ajar chime happens off randomly, the radio/time clock display screen cannot arrive if you do not pound inside that have your own little finger, additionally the body type occasionally jerks on the right when you are quickening, however it works higher! My husband pushes be effective from inside the a classic Camry he purchased to own $1500 having part of all of our tax reimburse one year. At this point i have $nine,538 saved up to replace our auto money and are usually hoping to accumulate at the least $ten,000 to expend into a different sort of trip. Already, we save $eight hundred a month towards that it mission insurance firms this new coupons automatically gone from our bank account for each and every pay day, so we never ever comprehend the currency and don’t miss it.

Dollars Budget

I also build a funds funds most of the pay-day; personally, this means I deduct all our debts (and therefore all get automatically withdrawn) from our overall equilibrium, after that withdraw any sort of are kept when you look at the dollars (without a small pillow to have problems). I’ve found that we spend less as i features a finite sum of money in my own purse and can actually find it depleting instantlyhaving fun with a charge card cannot be real enough to me personally. I additionally withdraw they from inside the large bills, since I will go without a little get, such a treat on premium grocery store close to my functions, which i failed to actually need, instead of split a $100 statement.

Desire

Private money desire, I really like this new posts DebtKickinMom, Brand new Frugalwoods, instructions by the Dave Ramsey, Suze Orman, hence you to definitely named Millennial Currency Makeover by the Conor Richardson. We have never then followed any one guru’s want to the brand new letter (healthy for you whenever you!), but We have without a doubt grown up my personal knowledge feet because of the training what the positives state did for them.

I also follow the Instagram hashtags #frugalliving, #debtfreejourney, and you can #debtfreecommunity. Scrolling such posts helps when my personal investing feels uncontrollable. I pick it-all secondhand, store only at Aldi, and usually pleasure our selves for the being non-acquisitive and conservative, but i do want to carry on road trips, participate in things and incidents, and you will I’m a touch too lured of the capability of eating food away into the workday.

Recent Comments