Specific lenders provide 90% so you’re able to 95% LTV HELOCs, but once again, such higher maximums go along with threats, instance are underwater in your family otherwise overloaded from the higher monthly obligations. Below are a few lenders giving higher LTV HELOCs and you will household guarantee loans:

Can you get an effective 100% LTV HELOC?

You might qualify for a 100% LTV HELOC out of Navy Federal Borrowing Union, whether or not an LTV restriction which high is pretty unusual. Nevertheless, additional borrowing unions promote this package:

Because this is your property-your primary place for cover-it creates me worried when anyone more than-power on their own to the level in which they can not protection the costs. You might be able to spend the money for commission on an excellent HELOC now, yet not, with a varying interest, so it percentage is also conform to a time in which it is no extended reasonable. When taking out any personal debt, I stand by 31%, meaning their complete financial obligation money ought not to go beyond 31% of one’s gross income.

Tips enhance your home security

Should you want to enhance your household collateral in order to eventually qualify to have a bigger HELOC or household equity financing, this type of measures could help in order to get your goal.

- Build bi-per week mortgage repayments

- Place extra to the the financial principal per month

- Pertain any windfalls for the financial prominent

- Wait for housing industry so you can change before applying

- Fix otherwise alter your household

Just how to get a HELOC otherwise house guarantee loan

If you have made a decision to move on with a good HELOC otherwise domestic guarantee loan, we have found specific insight into the overall techniques:

- Contrast loan providers and you can HELOC options

- Collect extremely important private and you can financial paperwork, also W-2s, tax statements, bank comments, shell out stubs, and a lot more.

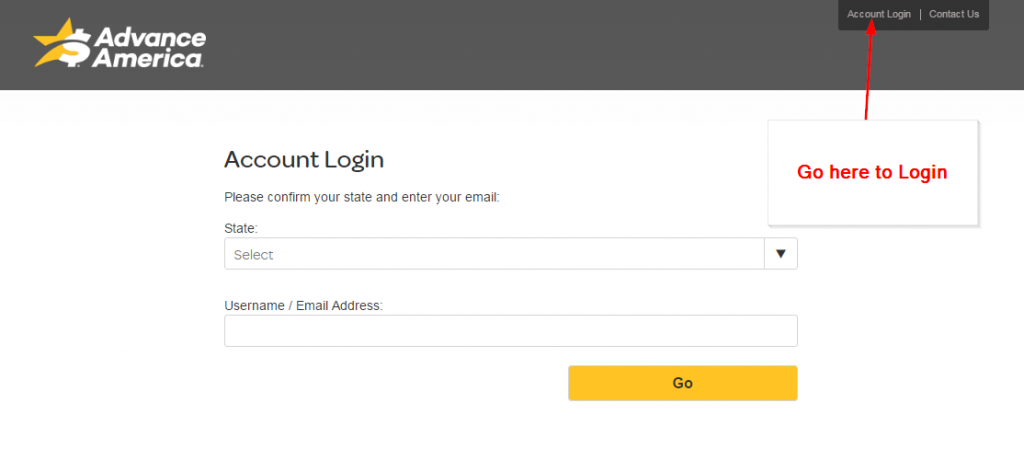

- Apply for a great HELOC online, over the phone, or even personal loan without a job or bank account in people

- Promote a lot more data files, whether your lender demands them, and you may await approval

Exactly what more affects my HELOC eligibility?

Your own financial often believe several products past LTV and you may CLTV ratios to determine for those who be eligible for a HELOC. Some tips about what they’re going to most likely feedback once you implement.

Generally speaking, loan providers in addition to purchase an assessment to assist influence industry worthy of of your house. The newest assessment techniques may vary because of the financial, with many demanding an in-person appraisal while others undertaking appraisals on the web. Your own house’s market price can assist determine their full guarantee.

Solutions to help you household security loans and you may HELOCs

If you don’t have enough guarantee of your home or try nevertheless exploring the options, think choices in order to domestic collateral fund and you will HELOCs.

Unsecured loans

An unsecured loan is actually a fixed-price installment financing from a bank, borrowing from the bank union, otherwise on the web bank. You are able to an unsecured loan for purpose, and additionally debt consolidating, renovations, otherwise issues.

Such financing are unsecured, meaning you do not chance shedding your home otherwise make payments. However, a potential disadvantage is the fact average personal bank loan costs are often greater than household equity loan cost.

Playing cards

Handmade cards act like HELOCs because you can borrow secured on a credit line as required. In place of HELOCs, however, you don’t need to pay closing costs or risk security in your house.

not, playing cards routinely have high cost than simply domestic guarantee finance and you can HELOCs. Otherwise spend their mastercard harmony in full for the or up until the due date, you might owe hundreds of dollars when you look at the focus.

Certain playing cards bring a 0% basic Annual percentage rate getting an appartment time frame, even when. Which advertisements Annual percentage rate have a tendency to applies to possess a dozen otherwise 18 months, enabling you to pass on your repayments over the years. A credit such as this would be worth considering if you’d like to finance an inferior expense; only always can pay what you owe until the advertising several months concludes.

Recent Comments